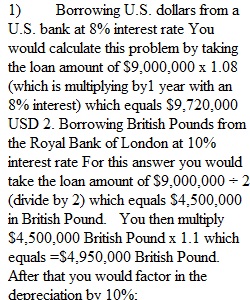

Q XCF Company wants to raise $9 million with debt financing to finance the entry into a foreign market. These funds are needed to finance working capital, and XCF will repay them with interest in one year. The company is considering three options: 1. Borrowing U.S. dollars from a U.S. bank at 8% interest rate 2. Borrowing British Pounds from the Royal Bank of London at 10% interest rate 3. Borrowing Euros from the Deutsche Bank in Frankfurt at 5% interest rate If XCF borrows in foreign currency, they will have to convert it immediately in dollars at today’s spot rate. In one year’s time, they will have to pay back the bank in the currency they borrowed it plus interest. To do so, they will convert U.S. dollars using the spot rate in a year’s time. Currently, the exchange rates are: 1 Euro = $1.50 and 1 British Pound = $2.00. The estimate of XCF’s CFO is that in one year, the British Pound will depreciate relative to the U.S. Dollar by 10% and the Euro will appreciate relative to the U.S. Dollar by 5%. From which bank should XCF borrow and why? Show all your calculations!

Q A small Canadian company in pharmaceuticals has developed a new drug and is considering selling it to the European Union market. The company is considering the following options: 1. Manufacture the product at home and let foreign agents handle marketing and sales. 2. Manufacture the product at home and set up a wholly owned subsidiary in Europe to handle marketing and sales. 3. Enter an alliance with a major European pharmaceutical firm. The product will be manufactured in Europe by the 50/50 joint venture and marketed by the European firm.

Q List all the information you would need to know before deciding which option is the best.Italy is one of the few European countries that Starbucks has not entered yet. Part of the reason is that Italians are the inventors of espresso coffee and that they have a lot of small neighborhood coffee places with strong local identities. Assuming that Starbucks hired you to organize an advertising campaign to enter the Italian market, how would you promote it? Specifically, describe in detail: 1. What key idea/concept would your advertisement try to convey to create a favorable image for Starbucks? 2. Describe in detail a TV commercial for the Italian target market for Starbucks.

View Related Questions